Notafettler

Guest

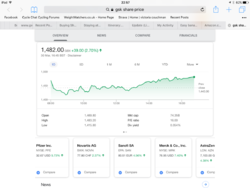

A better example

Perpetual income and growth

Opening price

184.60p

Year high

342p

Year low

157p

Based on present price 80% gain to get back to year high.

Present dividend 7.75%

Better still if you had it closer to the bottom!!

Perpetual income and growth

Opening price

184.60p

Year high

342p

Year low

157p

Based on present price 80% gain to get back to year high.

Present dividend 7.75%

Better still if you had it closer to the bottom!!

Last edited: