How common is it for companies to pay mileage allowance for cycling.

Probably not to and from work , but for work related journeys ?

I only do an occasional shift for a care provider, and go round to visit people at home.

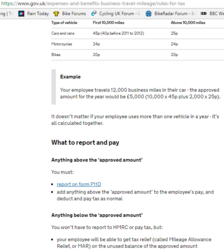

The expenses sheet says 40p per mile for car use, 25p for motorbikes and 20 for cycling.

I love getting the occasional few quid for my efforts.

Of course they're also paying wages while I pedal along.

Probably not to and from work , but for work related journeys ?

I only do an occasional shift for a care provider, and go round to visit people at home.

The expenses sheet says 40p per mile for car use, 25p for motorbikes and 20 for cycling.

I love getting the occasional few quid for my efforts.

Of course they're also paying wages while I pedal along.